Not known Facts About Offshore Wealth Management

They can give you with the option of a routine revenue as well as likewise aid you to decrease your individual responsibility to Income and also Capital Gains Tax. The value of a financial investment with St. offshore wealth management. James's Location will be straight connected to the efficiency of the funds you pick and the value can consequently go down in addition to up.

The degrees and bases of taxation, and also alleviations from taxes, can transform at any type of time. The value of any tax obligation relief depends upon specific circumstances.

Offshore Wealth Management Things To Know Before You Get This

Lots of capitalists use conventional financial investments like an actual estate and banking products, at dealt with prices. From the long-term investment point of view, it can be much wiser to spend in funding holders whose efficiency is constantly more eye-catching.

Trust funds are exceptional investment cars to shield properties, as well as they have the capability to hold a wide selection of property classes, including home, shares as well as art or collectibles - offshore wealth management. They additionally enable reliable circulation of possessions to beneficiaries. An overseas trust fund that is managed in a protected jurisdiction enables reliable wide range creation, tax-efficient monitoring and also succession preparation.

How Offshore Wealth Management can Save You Time, Stress, and Money.

Customers who fear that their properties might be iced up or confiscated in case of prospective political turmoil view offshore financial as an appealing, secure means to protect their assets. Several offshore accounts thin down the political danger to their wide range and minimize the hazard of them having their assets frozen or taken in an economic dilemma.

With enhanced tax obligation openness and also tightening up of global laws, it has come to be much more tough for people to open overseas accounts. The international suppression on tax obligation evasion has actually made offshore less attractive and Switzerland, in certain, has actually seen a decline in the number of offshore accounts being opened.

Onshore, offshore or a combination of the 2 will make up an exclusive lender's client base. The equilibrium for each banker will be various depending upon where their customers wish to schedule their properties. Collaborating with overseas clients needs a slightly site various strategy to onshore clients and also can consist of the complying with on the component of the lender: They might be needed to cross boundaries to visit clients in their residence nation, even when the financial institution they belong to does not have a long-term facility located there, Possibly take complete obligation for managing portfolio for the customer if the client is not a homeowner, Be multilingual in order to effectively communicate with clients and also develop their customer base internationally, Know global regulations as well as policies, particularly when it come to overseas investments and also tax, Be able to connect their clients to the right experts to assist them with different areas from tax through to even more sensible support such as helping with building, moving, immigration advisors as well as education and learning consultants, Know the most up to date concerns impacting worldwide customers and ensure they can produce services to meet their needs, The financial institution and also particular group within will certainly figure out the populace of a banker's customer base.

What Does Offshore Wealth Management Mean?

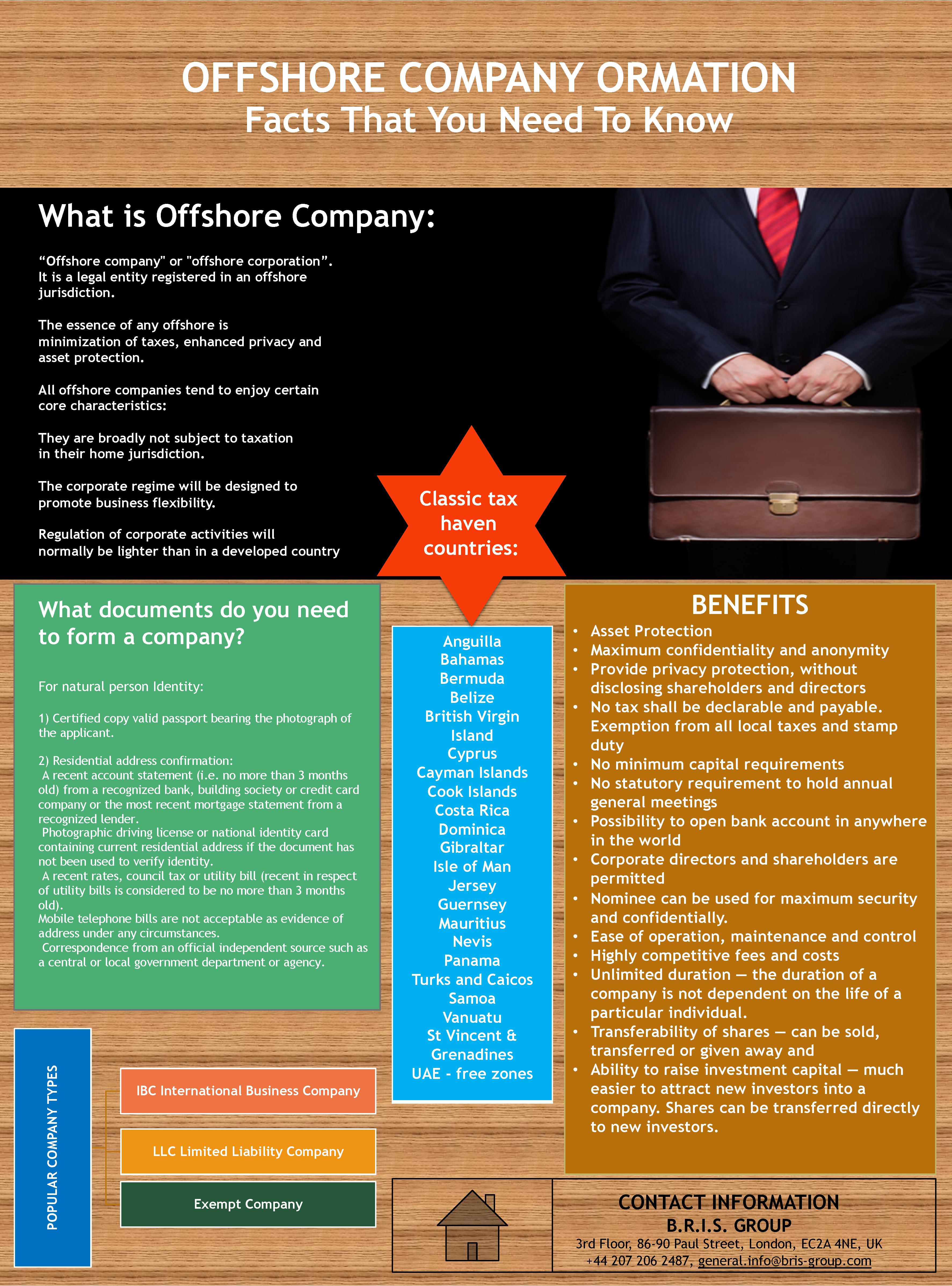

Associates with the broader financial services market in overseas find more facilities Offshore financial investment is the maintaining of cash in a jurisdiction besides one's nation of home. Offshore jurisdictions are used to pay less tax in many countries by big and also small-scale investors. Inadequately managed offshore residences have actually offered historically as sanctuaries for tax obligation evasion, money laundering, or to hide or safeguard illegally gotten money from legislation enforcement in the capitalist's nation.

The advantage to overseas financial investment is that such procedures are both legal and also less pricey than those provided in the investor's countryor "onshore". Areas favored by capitalists for reduced prices of tax obligation are understood as overseas financial facilities or (sometimes) tax obligation havens. Repayment of less tax obligation is the driving pressure behind a lot of 'offshore' activity.

Frequently, taxes imposed by an investor's residence country are essential to the success of any kind of offered investment - offshore wealth management. Utilizing offshore-domiciled unique objective systems (or vehicles) a capitalist may decrease the amount of tax obligation payable, allowing the financier to accomplish greater productivity overall. Another reason that 'offshore' investment is thought about above 'onshore' financial investment is since it is much less controlled, and the behavior of the overseas financial investment carrier, whether he be a lender, fund manager, trustee or stock-broker, is freer than maybe in a much more regulated setting.

The Buzz on Offshore Wealth Management

Safeguarding against currency decrease - As an example, Chinese financiers have actually been spending their savings in secure Offshore places to protect their against the decline of the renminbi. Factors which have actually been advanced versus offshore financial investment include: They bypass security exchange regulation took into area after the terrific clinical depression (e.e. offshore wealth management., it can not be exhausted once again when re-spent to supply services and facilities). It motivates Tax obligation competitors in between states, districts, countries, as well as regions, similarly that the search for ever before less costly source of hands-on labor lowers salaries everywhere. Offshore investments in poorly controlled tax obligation havens may bypass permissions versus nations established to encourage conventions crucial to cultures (e.Firms are easily produced in Panama as well as, although they are greatly tired on Panama-domestic procedures, they pay no taxes on foreign activities. see post Business possession can be conveniently concealed with making use of confidential "holder shares". As an outcome, more than of 45,000 offshore shell business as well as subsidiaries business are developed in Panama yearly; Panama has among the highest possible concentrations of subsidiaries of any type of country on the planet.